Swiss Corporate Sustainability Reporting

Federal Council Proposes to Align Current Rules With the EU Corporate Sustainability Reporting Directive

On June 26, 2024, the Swiss Federal Council opened a consultation process regarding potentially stricter corporate sustainability reporting for Swiss companies. The proposed amendment (the Draft Amendment) of articles 964a – 964c of the Swiss Code of Obligations (CO) is intended to bring the current Swiss non-financial matter reporting provisions in line with the EU Directive 2022/2464 of December 14, 2022 on corporate sustainability reporting (Corporate Sustainability Reporting Directive, CSRD). The consultation process lasts until October 31, 2024.

Rather than fully replicate the CSRD, the Federal Council has proposed modifying the existing reporting requirements on non-financial matters under the CO, including by broadening its scope of application, with the effect that more companies will be required to prepare and publish a report on sustainability aspects. According to the Federal Council, whereas the existing reporting obligations affect around 300 companies, the proposed rules would obligate approximately 3,500 companies to report on risks relating to the environment, human rights, and corruption, and the measures they are taking to mitigate these risks.[1]

The main changes proposed by the Draft Amendment are summarized in the table under Section A, followed by a more detailed discussion of key aspects of the Draft Amendment.

A. Overview of Key Changes to the Existing Rules

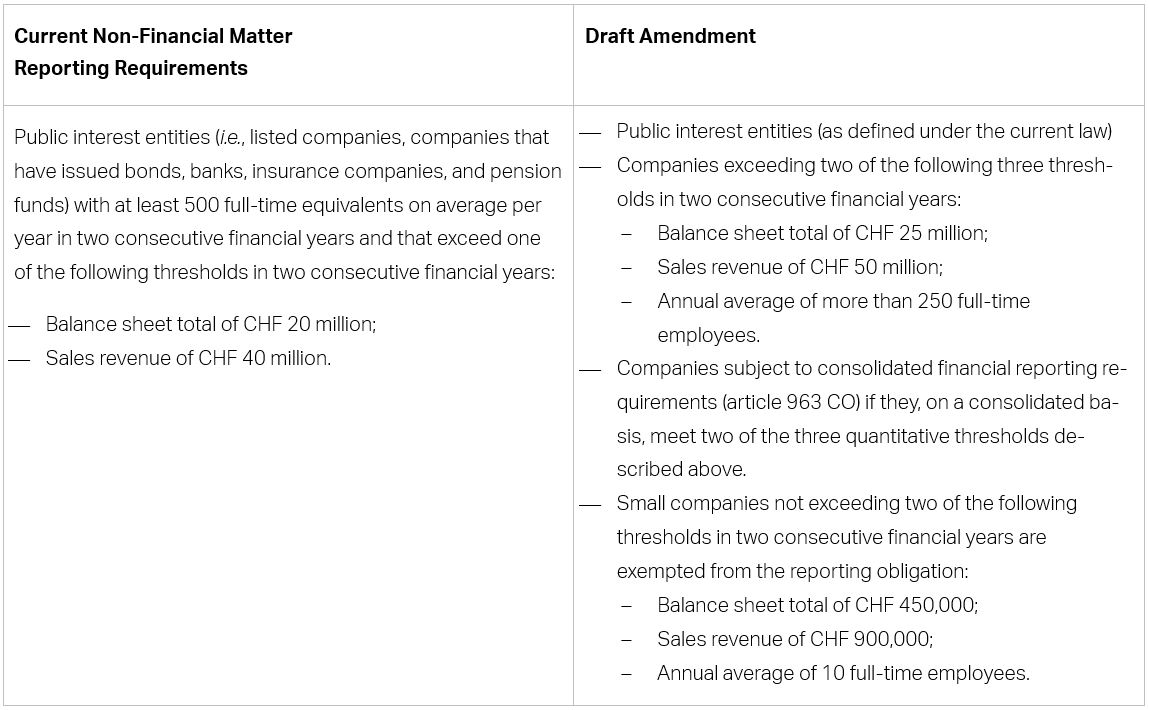

1. Scope:

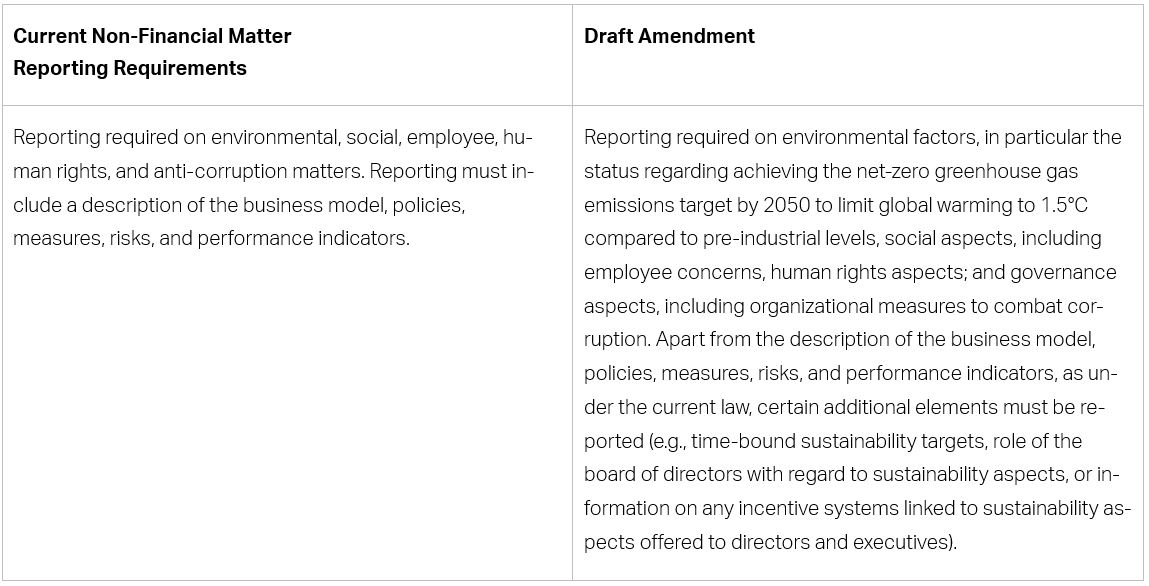

2. Content:

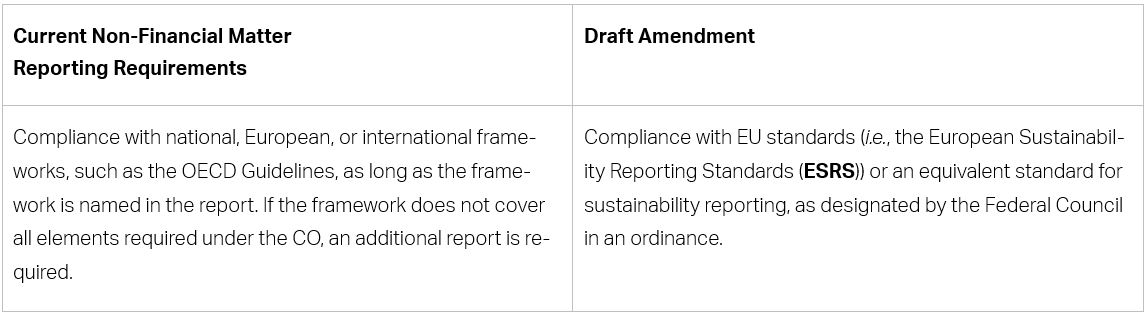

3. Reporting standard:

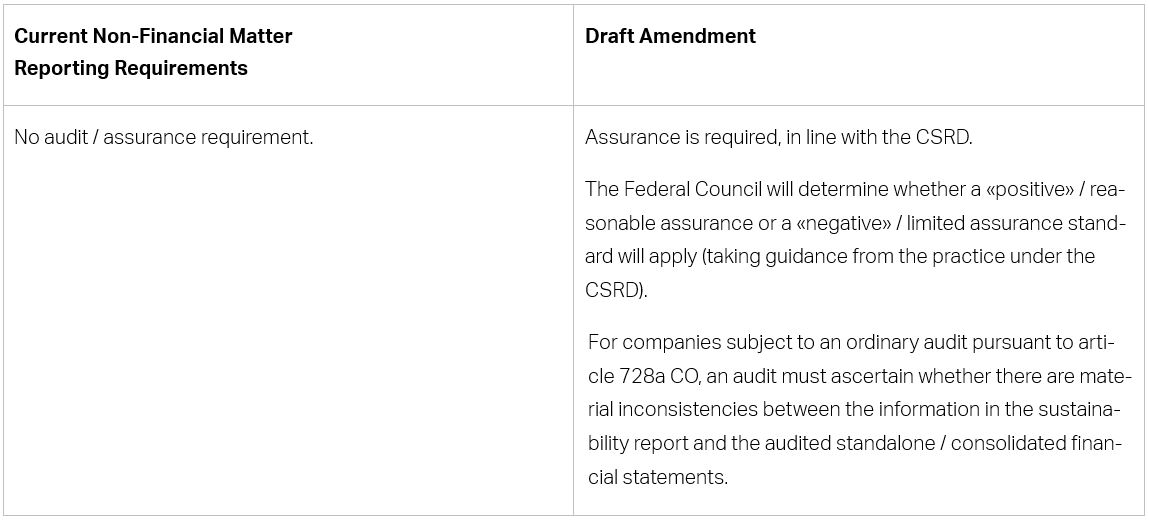

4. Audit / assurance requirements:

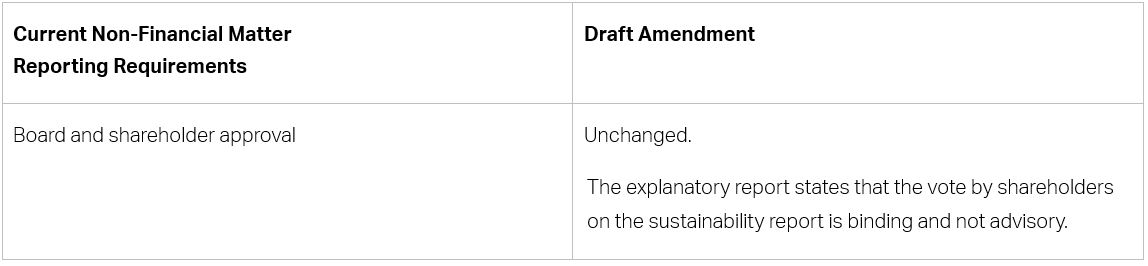

5. Approval requirements:

B. Key Aspects of the Draft Amendment

1. Extended Scope

The proposed modified sustainability reporting provisions would apply to the following entities:

- «Public interest entities» (Gesellschaften des öffentlichen Interesses);

- Companies that exceed two of the following figures in two consecutive financial years: (i) total assets of CHF 25 million; (ii) revenue of CHF 50 million; (iii) 250 full-time employee positions per year on average;

- Companies obliged to prepare consolidated financial statements and that exceed two of the thresholds in (b) above in two consecutive financial years.

As of today, only «public interest entities» with at least 500 full-time equivalents on annual average in two consecutive financial years that exceed either the relevant balance sheet total (CHF 20 million) or revenue threshold (CHF 40 million) in two consecutive financial years are subject to the non-financial matters reporting requirements.

Under the Draft Amendment, «public interest entities» are generally subject to the new reporting requirement, regardless of whether they meet any of the quantitative thresholds described in item (b) above, unless they qualify as an exempted small company (as further described below). In addition, any company, irrespective of whether it qualifies as a «public interest entity», that satisfies two of the three quantitative thresholds described in item (b) above on a standalone or a consolidated basis would also have to establish a sustainability report. The Draft Amendment also contemplates reducing the «full-time equivalents» from 500 to 250.

Companies that would otherwise have to report but are controlled by another company that prepares a Swiss law sustainability report or an equivalent report under foreign law are exempt. Also exempt are small companies that alone or together with domestic or foreign companies that they control do not exceed two of the applicable thresholds (viz. total assets of CHF 450,000, sales revenue of CHF 900,000, 10 full-time employees on annual average in two consecutive years).

2. Annual Sustainability Report: Format

Companies subject to the Draft Amendment would continue to be obliged to produce an annual sustainability report. The annual sustainability report may be prepared as a separate report or, in alignment with the CSRD, it may be integrated into the management report pursuant to article 961c CO. The report must be in an electronic reporting format established in accordance with an internationally recognized standard, namely the one used by the EU member states.

3. Reporting Requirements

Compared to the existing non-financial matter reporting, the Draft Amendment further expands and specifies the scope of the information on sustainability. The current law’s terminology would largely be replaced with new terms that have a similar meaning. The information to be reported on is described as follows:

- Environmental factors (e.g., climate protection – including greenhouse gas emissions, water and marine resources, resource utilization and the circular economy, soil, water, and air pollution, and biodiversity and ecosystems – as well as human health and safety and the use of renewable and non-renewable energy, including exposure to coal and oil-and gas-related activities);

- Social aspects, including employee matters (e.g., measures to protect various interest groups (such as shareholders, employees, and customers), working conditions, diversity, measures against violence and harassment, disability accommodations, and work-life balance);

- Human rights aspects; and

- Governance aspects (e.g., the role of the board of directors and management in respect of sustainability aspects, the strategy for linking incentives for board and management members to sustainability aspects, internal controls and risk management systems related to sustainability, policies and measures to combat corruption).

In line with the reporting requirements under the Federal Ordinance on Reporting on Climate of November 23, 2022, which became effective on January 1, 2024, the Draft Amendment requires in-scope companies to report on the statues regarding achieving the net-zero greenhouse gas emissions target by 2050 to limit global warming to 1.5°C above pre-industrial levels. This will include reporting on Scope 1, Scope 2 and, where applicable, Scope 3 greenhouse gas emissions in accordance with the current GHG Protocol Corporate Accounting and Reporting Standard.

The Draft Amendment would also expressly require reporting on governance matters, beyond reporting on the combat of corruption.

Like the existing law, the Draft Amendment continues to list specific sustainability aspects that must be described in the report in more detail, such as the company’s business model and strategy, applied due diligence processes in respect of sustainability aspects, material risks the company faces with respect to sustainability aspects or material financial, and non-financial performance indicators. However, the list included in the Draft Amendment adds new items, such as a description of the time-bound sustainability targets that the company has set itself, a description of the role of the board of directors in relation to sustainability, or information on any incentive systems linked to sustainability that are offered to directors and executives.

The most significant change to current non-financial matter reporting is that all information must be provided in compliance with the standards used in the EU (i.e., the European Sustainability Reporting Standards (ESRS)) or another equivalent standard for sustainability reporting (the explanatory report also mentions the IFRS Sustainability Disclosure Standards or the Global Reporting Initiative (GRI) as examples). The selected standard must be adopted in its entirety. The Federal Council will designate the standards that are equivalent to the ESRS in an ordinance.

Under the Draft Amendment, the applicable standard will be determined by the board of directors; however, the standard may also be determined based on a shareholder vote at a general meeting.

Further information regarding the specific reporting matters is available in the Federal Council’s related explanatory report.[1]

4. Double Materiality Principle

The Draft Amendment clearly establishes the principle of «dual materiality» in line with the CSRD. The sustainability report must therefore disclose the information necessary to understand the impact of the company’s activities on sustainability issues and the impact of sustainability issues on the company’s business, financial performance, and position.

In contrast with the current law, in which the principle of «double materiality» already applies, the proposed draft seeks to clarify that, in accordance with EU law, information must be disclosed that is material under both aspects as well as information that is material under only one aspect.

5. «Comply or Explain»

The option available under the current law to waive reporting on certain sustainability topics under certain conditions («comply or explain») would no longer be available under the Draft Amendment. The «comply or explain» approach is also not available under the CSRD framework.

6. New Auditing and Assurance Requirements

The current law does not impose any audit or assurance requirements on the reporting of non-financial matters. By contrast, under the Draft Amendment, the sustainability information included in the report must be made subject to assurance. Either independent audit firms[2] or conformity assessment bodies (Prüfgesellschaft) may provide assurance.

The Federal Council will determine, taking into account international developments, including EU law, whether any assurances from audit or conformity assessment bodies should take the form of a «positive» / reasonable assurance or a «negative» / limited assurance. The EU contemplates introducing a positive reasonable assurance requirement by October 1, 2028.

In addition, in respect of companies subject to an ordinary audit pursuant to article 728a CO, the Draft Amendment would require the statutory auditor to conduct an audit on whether there are material inconsistencies between the information in the sustainability report and the audited standalone and consolidated financial statements. This audit review does not include a material audit of the accuracy of completeness of the information published in the sustainability report.

7. Shareholder Vote

The Draft Amendment maintains the requirement that the sustainability report be approved by shareholders at each annual general meeting. The CSRD does not require shareholder approval of sustainability reports. The explanatory report to the Draft Amendment expressly states that the shareholder vote on the sustainability report is binding, and not advisory, contrary to the currently prevailing practice under the existing law.[3]

8. Criminal Law Provisions

The criminal law sanctions for an inaccurate or incomplete report remain unchanged in substance. A fine of up to CHF 100,000 will be imposed on anyone who intentionally makes false statements in the reports, fails to make the required reports, or fails to comply with the legal obligation to keep and store the report.

9. Timeline

The Federal Council will determine the date on which the new provisions become effective. Companies will then have two years to adapt to the new law. During this two-year transition period, the current law will apply.

[1] See Federal Council, «Änderung des Obligationenrechts (Transparenz über Nachhaltigkeitsaspekte): Erläuternder Bericht zur Eröffnung des Vernehmlassungsverfahrens», 25-33 (available at https://www.newsd.admin.ch/newsd/message/attachments/88435.pdf).

[2] Pursuant to article 6a of the Auditor Oversight Act of December 16, 2005

[3] See Federal Council, «Änderung des Obligationenrechts . . .» at 36-37.

[1] See Federal Council, «Nachhaltige Unternehmensführung: Bundesrat schlägt strengere Regeln für Berichterstattung vor» (June 26, 2024), available at https://www.admin.ch/gov/de/start/dokumentation/medienmitteilungen.msg-id-101585.html.

If you have any queries related to this Bulletin, please refer to your contact at Homburger or to:

Legal Note

This Bulletin expresses general views of the authors as of the date of this Bulletin, without considering any particular fact pattern or circumstances. It does not constitute legal advice. Any liability for the accuracy, correctness, completeness or fairness of the contents of this Bulletin is explicitly excluded.